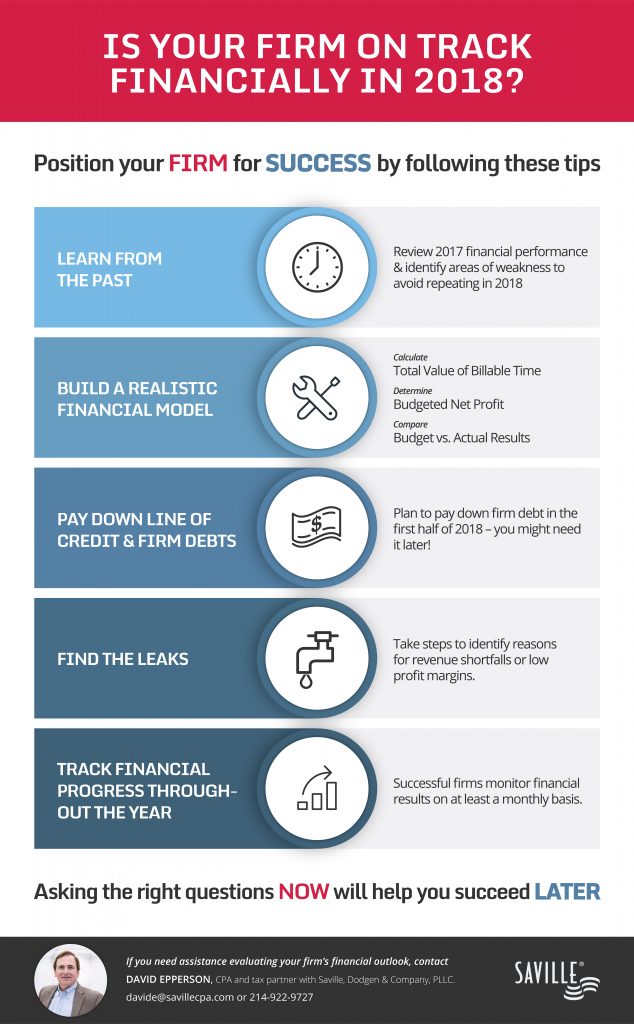

Partners often monitor financial performance by keeping a close eye on the bank account to make sure there’s sufficient cash to meet payroll and other expenses. However, there are other key financial steps that need to be taken to track how the firm is performing. The following tips will help you make sure your firm is on track financially in 2018.

80% Revenue Capacity = GOAL

- Know what to expect – It’s important for a law firm to compare its actual revenue to its revenue capacity. Start by determining the amount of revenue the firm should be able to generate this year with timekeepers working at their highest and most efficient level. This is determined by multiplying anticipated billable hours by the standard hourly rate of each timekeeper. Then compare to the firm’s actual revenue. Firms that operate at a 60%-70% of capacity over a period of time may be in danger while firms with an 80%-85% revenue capacity ratio should be profitable with room for improvement.

30 Minutes each Week to Review Billable Time

- Track timekeeper productivity to make sure attorneys and legal assistants are meeting billable hour targets each week – According to a 2017 Legal Trends Report, lawyers logged 2.2 hours of billable time per day. To make things worse, lawyers collected on average 1.5 hours of billable time per day. The number of hours worked (utilization) is important. Each timekeeper should have billable hour targets that need to be monitored weekly, not monthly, set aside 30 minutes each week to track progress.

< 50 Days to Bill

- Stay on top of the firm’s billing turnover rate – Timekeepers may be producing good billable hours. But how quickly are those hours getting billed? A good benchmark is that it should take less than 50 days to send out bills once the work is produced. Also, you need to keep an eye on the firm’s WIP aging report to make sure unbilled time is not growing too large. A good rule of thumb is to keep your WIP balance less than 2 ½ times average monthly billings

< 70 Days to Collect

- Stay on top of the firm’s collection turnover rate – How long does it take to collect unpaid fees once the time is billed? Most firms do a pretty good job getting bills out. But most firms do a poor job collecting receivables. A firm’s receivable turnover rate should be less than 70 days. Also, the firm’s total accounts receivable balance may be too large if it equals two times average monthly billings. A low collections rate may be a sign of poor up-front communications concerning pricing with clients.

85% – 90% Realization

- Keep an eye on overall firm realization – Realization is the percentage of billable hours that are billed and collected. Depending on the type of law firm, a firm should expect to collect 85%-90% of billable hours worked at standard rates. Track realization by each timekeeper. If everyone is busy but the firm has low realization, you need to dig deep to find the source of the problem.

The financial goal of a law firm is to maximize profits. To maximize profits, you need a financial plan that will help you measure progress and signal potential problems. What are the numbers telling you? Are you on the way to a profitable year or are there issues you need to address? It’s early in the year so you have time to get your financial house in order. Asking the right questions now will help you succeed later. If you need help reviewing your firm’s financial results, look to a CPA that specializes in helping law firms manage the financial side of the practice.

David Epperson is a CPA and tax partner with Saville, Dodgen & Company, PLLC. He has over 30 years of experience working with law firms and other professional services organizations. As a CPA, he understands how law firms operate and helps firms anticipate issues, address problems, and implement solutions. He can be reached at davide@savillecpa.com or (214)-922-9727.