The United States Supreme Court accepted an appeal by multiple state attorneys regarding the Patient Protection and Affordable Care Act (PPACA) on March 2, 2020. This court case named California v Texas, formerly known as Texas v. U.S., claims that the requirement for individuals to carry health insurance is unconstitutional and confirmed by the elimination of the individual mandate penalty. The Court will now move forward with determining if and what portions of the PPACA are unconstitutional.

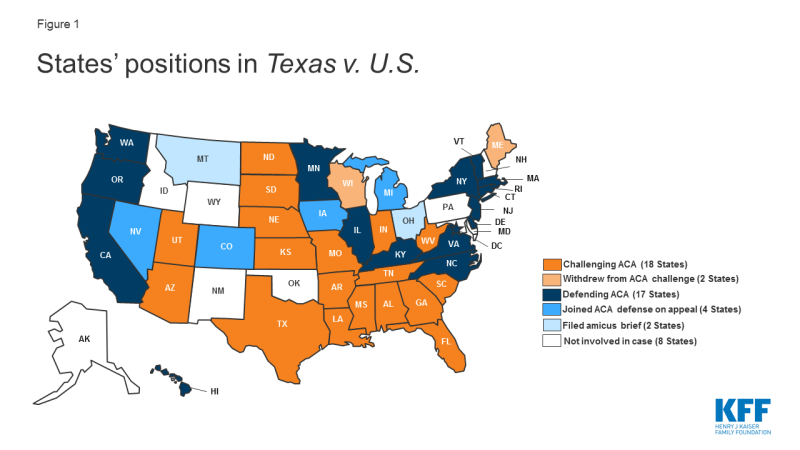

Below is a map of where every state stands on the issue.

How could this affect our clients?

If the PPACA is determined to be unconstitutional, this could affect taxes applying to many taxpayers – including the 3.8% Net Investment Income Tax, the 0.9% Additional Medicare Tax, and the individual shared responsibility payment. In addition to that, businesses that have paid the employer shared responsibility payment after failing to provide essential minimum health coverage to employees could possibly have the opportunity to recover those amounts.

The Court could also decide that only specific portions of the PPACA are invalid but that certain tax provisions continue in effect as a constitutional execution of the authority of Congress to impose taxes.

We are not sure what the verdict will be. However, due to the timing of this case, we are quickly entering the end of the limitation period to make a claim refund for 2016, which is July 15th 2020. The Court has announced that the decision is going to pass late either this year or in 2021.

What steps are we taking?

Even with the looming limitation period, taxpayers have the option to file a protective refund claim with the IRS, a protective refund claim secures the right to claim a refund when the issue is resolved, even if the verdict takes place after the period runs out.

We are assessing client filings for potential tax refunds to determine who should file a protective refund claim. The filing required would include a 2016 Form 1040-X, amended return.

This information is based upon the most recent guidance issued as of today. To ensure that you are following the most up to date guidance and if you have any urgent questions, please contact your Saville Relationship Manager.