Last year is in your rear view mirror, so before you get too far into the second quarter, you need to take steps to make sure you know what to look for to achieve financial success in 2018. More than ever, firm owners need to practice sound financial management to quickly identify problem areas and make necessary corrections throughout the year.

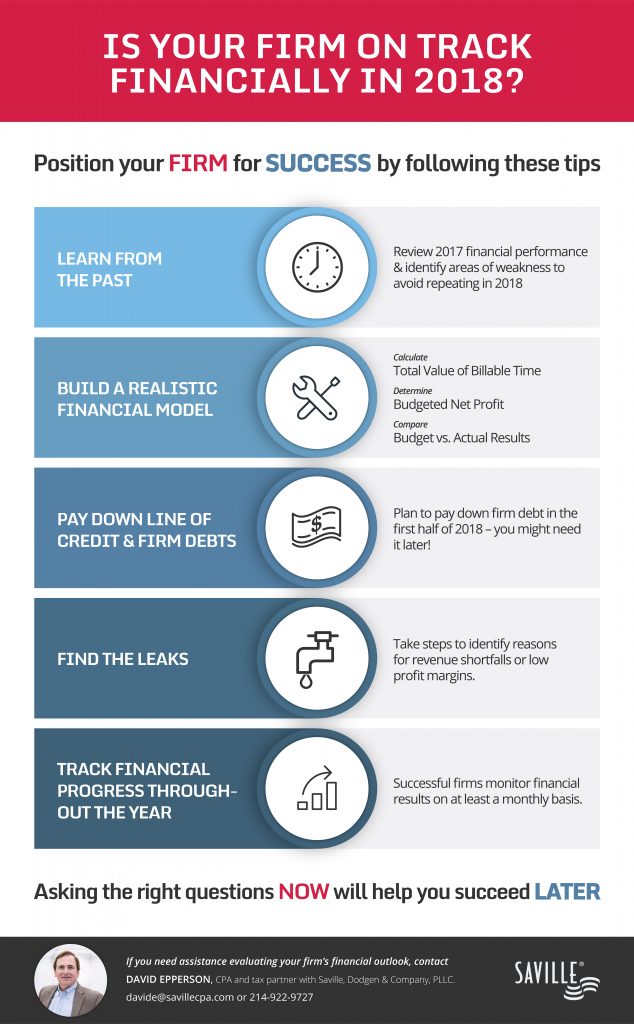

The following tips will help you make sure your firm is on track financially in 2018.

- Learn from the past – Take time to review last year’s financial performance for areas of weakness you don’t want to repeat this year. Did the firm meet its profit goals? If not, why not? Which practice areas reported negative revenue growth? Which attorneys and legal assistants performed below expectations? Who didn’t meet their billable hour target? Did the firm meet its billing and collection realization goals? How did the firm actual results compare to budget?

- Create a realistic 2018 financial model – Sound financial management starts with the preparation of a monthly budget or financial plan. In a top down budget, calculate the value of billable time by multiplying expected billable hours by the standard billing rate of each timekeeper. Then factor in billing write-downs and receivable write-offs to arrive at projected monthly firm collections. Determine monthly expenses by functional categories such as compensation, payroll taxes, other personnel costs, occupancy costs, professional expenses, practice development activities, technology and other operating expenses. Subtract expenses from revenue to determine budgeted net profit. Then compare budget to actual results on a monthly and year to date basis.

- Plan to pay down line of credit and firm debt when cash flow allows – Most firms draw on their line of credit in the first quarter to cover overhead expenses before billings and collections catch up in the second quarter. It’s normal for firms to rely on their working capital line of credit to cover operating costs and partner draws in January and February but not in November and December. Banks don’t like it when firms don’t pay down the line of credit during the year. So plan to pay down firm debt in the first half of the year because you might need it later.

- Find the leaks – Take steps to identify the reasons for any revenue shortfalls or low profit margin. Potential problems might include excess capacity, unrecorded time, fee discounts, inefficiency write-downs, fee write-offs due to client perception of value, and failure to control expenses.

- Track financial progress during the year by reviewing key financial management reports – Successful firms monitor financial results on at least a monthly basis during the year. Key reports include a monthly budget, profit/loss statement, balance sheet, billable hours report, billings report, cash receipts report, aged WIP report, aged A/R report, and billing and collections realization reports.

The financial goal of a law firm is to maximize profits. To maximize profits, you need a financial plan that will help you measure progress and signal potential problems. What are the numbers telling you? Are you on the way to a profitable year or are there issues you need to address? It’s early in the year so you have time to get your financial house in order. Asking the right questions now will help you succeed later. If you need help reviewing your firm’s financial results, look to a CPA that specializes in helping law firms manage the financial side of the practice.

David Epperson is a CPA and tax partner with Saville, Dodgen & Company, PLLC. He has over 30 years of experience working with law firms and other professional services organizations. As a CPA, he understands how law firms operate and helps firms anticipate issues, address problems, and implement solutions.