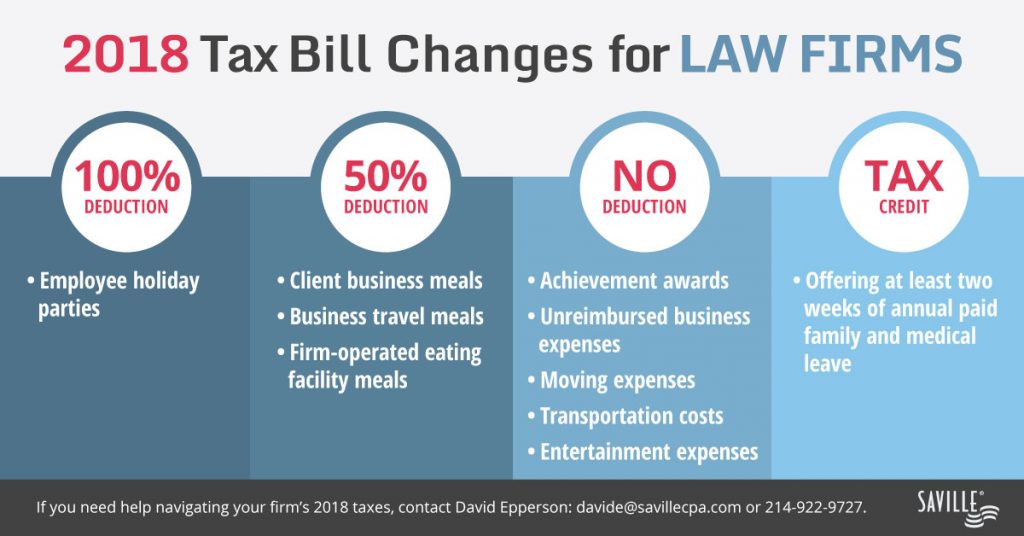

With the passage of the Tax Cuts and Jobs Act this past December, law firms are scrambling to figure out how the new bill will affect them. With tax season on the horizon, this is what your firm needs to be aware of.

- Transportation-related fringe benefits – Firms can no longer deduct the cost of employee transportation such as on-site parking, mass transit passes, and bicycle commuting reimbursements. Before passage of the new bill, these costs were deducted by the employer and excluded from the employees’ income. This deduction is no longer allowed, whether paid directly by the employer or through a reimbursement arrangement or compensation reduction agreement. However, employees may still exclude the value of commuter benefits purchased with pre-tax salary contributions through an employer-sponsored salary-deduction program, such as a Section 125 plan, from their gross income.

- Meals and entertainment

- Entertainment expenses are not deductible. Before 2018, law firms could write-off 50% of business-related entertainment costs, but no longer. This means no more sporting events, show tickets, or trips to the golf course, even if taking clients.

- Employee holiday parties are still fully deductible.

- Employee meals on business travel are still 50% deductible.

- Meals at a firm-operated eating facility are now limited. Businesses used to be able to deduct the entire expense. Now the write-off is subject to a 50% limit. After 2025, the cost is fully disallowed.

- Deducting the cost of client business meals is not 100% clear. The general consensus is that the meals remain 50% deductible. However, to be safe, the meals should not be so lavish as to be deemed entertainment. Just to be safe, firms should document the purpose of the meal and track the expense in a separate ledger account.

- Employer-provided moving expense reimbursements – This benefit is no longer excluded from employee income. Before 2018, an employee could exclude the costs of qualified moving expense reimbursements, paid by the employer, from their own income. The reimbursement was excluded from wages for employment taxes. Starting in 2018, moving expense reimbursements are fully taxable to the employee.

- Employee unreimbursed business expenses – Before the new tax bill, an employee could deduct unreimbursed employee business expenses as a miscellaneous itemized deduction subject to a 2% adjusted gross income limitation. Beginning in 2018, however, miscellaneous itemized deductions are no longer allowed. So, if a law firm reimburses the employee for a business expense, the reimbursement is not taxable to the employee. However, if the firm does not reimburse the employee, the employee will no longer be able to claim a tax deduction for the expense.

- Employee achievement awards – Before 2018, employers could deduct up to $400 the value of certain employee achievement awards for length of service or safety. In the case of certain written nondiscriminatory achievement plans, that limit was $1,600. To the extent the award does not exceed the employee’s deduction, the employee recipient could exclude the award from income. Beginning in 2018, this tax break no longer applies to cash, gift coupons/certificates, vacations, meals, lodging, tickets to sporting or theater events, securities, and “other similar items”.

- Tax credit for paid family and medical leave – Beginning in 2018, firms that offered at least two weeks of annual paid family and medical leave are entitled to a tax credit. The paid leave must provide for at least 50% of wages normally paid to the employee. The credit equals 12.5% of wages paid to a qualifying employee during the employee’s leave, increased by .25% for each percentage point the employee’s rate of pay on leave exceeds 50% of the wages normally paid to the employee (but not to exceed 25% of wages paid).

With these recent changes in mind, law firms should review company policies relating to reimbursements for commuting, moving, and employee business expenses. Accounting for meals and entertainment expenses should be revised to make sure they’re reported properly on the law firm’s tax returns. Lastly, firms should give some thought to utilizing the new tax credit for paid family and medical leave.

David Epperson is a CPA and tax partner with Saville, Dodgen & Company, PLLC. He has over 30 years of experience working with law firms and other professional services organizations. If you have questions about your firm’s 2018 taxes under the new tax bill, please contact David Epperson at davide@savillecpa.com or (214)-922-9727.